In an intriguing move, De Beers has announced its intention to close down its lab-grown diamond business, reiterating its commitment to natural diamonds. As part of the process, De Beers will sell its current assets to interested clients. Established in 1888, De Beers Group is the world’s leading diamond company which is involved in exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people in the diamond industry and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa.

It’s lab-grown brand, Lightbox, was established in 2018, to highlight the two separate product categories, natural vs synthetic diamonds, with diverse attributes and price points. It was launched with a transparent pricing of $ 800 per carat. However, the price points of lab-grown diamonds have fallen since then by over 90 percent in wholesale. This steep decline in price point is allegedly one of the reasons the brand has decided to shut shop on its lab-grown business. De Beers, for all intents and purposes, now wants to focus on its natural diamond business, which are high-cost and handcrafted, distinguishing them from the low-cost, mass-produced lab-grown jewellery business. Al Cook, Chief Executive Officer of De Beers Group, said: “As we move towards becoming a standalone company, we continue to optimise our business, reduce costs and build a focused De Beers that is positioned for profitable growth.

Declining value

“The persistently declining value of lab-grown diamonds in jewellery underscores the growing differentiation between these factory-made products and natural diamonds. Lightbox has helped to highlight the fundamental differences in value between these two categories. Global competition continues to intensify with more low-cost lab-grown diamond production from China. In the US, supermarkets are driving down lab-grown diamond jewellery prices. Overall, we expect both the cost and price of lab-grown diamonds to fall further in the jewellery sector. The planned closure of Lightbox reflects our commitment to natural diamonds. We are also excited at the growing commercial potential for synthetic diamonds in the technology and industrial space.”

While it is exiting the business for good, De Beers has publicly announced to work closely with its suppliers, retailers, employees and other stakeholders to ensure a smooth process. Customers who have previously made purchases from the brand will be able to avail after-sales services, including warranties, during the closure process.

The proposed closure of the Lightbox business reflects a key executional milestone in De Beers Group’s Origins Strategy, as set out in May 2024, to focus on high-return activities and streamline the business. The closure will enable De Beers Group to reallocate investment to initiatives focused on reinvigorating desire for natural diamonds through category marketing.

Growing demand for lab-grown diamonds

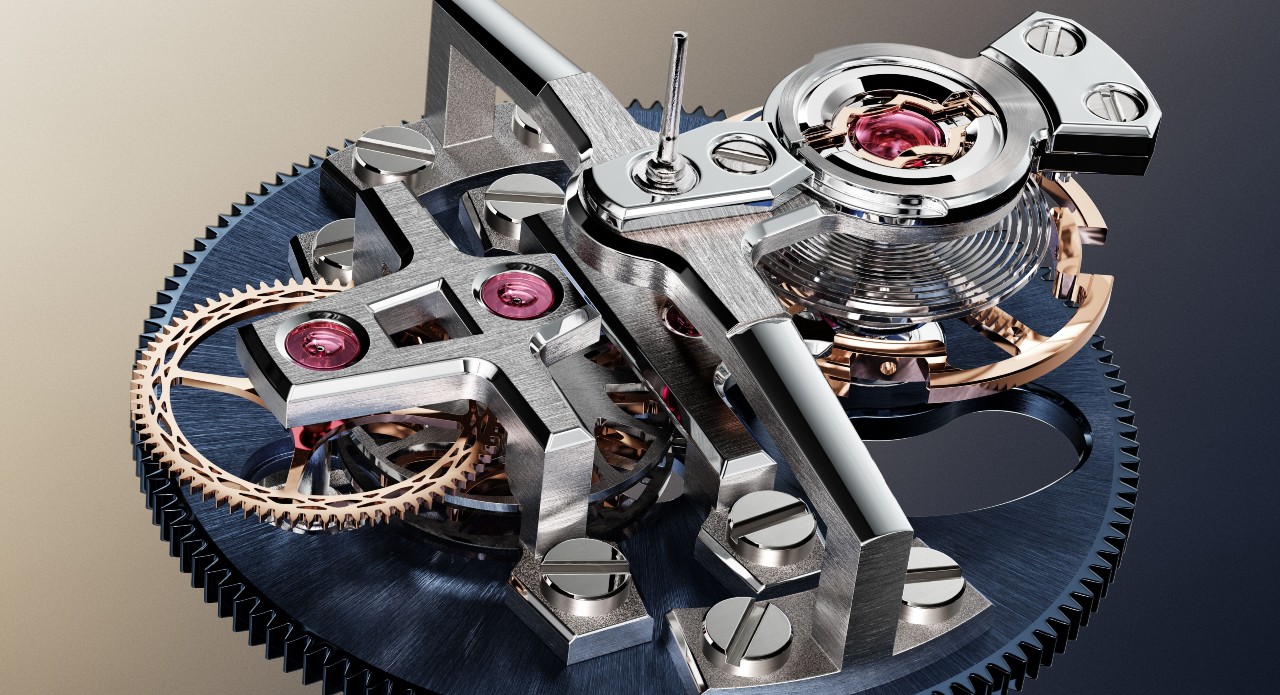

Element Six, De Beers Group’s subsidiary that previously produced lab grown stones for Lightbox, maintains its exclusive focus on industrial solutions using synthetic diamonds. Building on its world-leading status developed over more than seven decades, Element Six is well-positioned to seize the rapidly growing potential for synthetic diamond applications across a range of future-facing technologies and applications. By centralising CVD (chemical vapor deposition) synthetic diamond production at its state-of-the-art facility in Oregon, US, Element Six will work with its growing global network of partners to accelerate cutting-edge technologies for high growth industries, such as semiconductors and quantum technologies. With a track record of growth and profitability, Element Six is favourably positioned to drive the future of synthetic diamond solutions in industrial and high-tech applications.